Game Theory (3,3)

The Game (Theory) of Olympus Doge

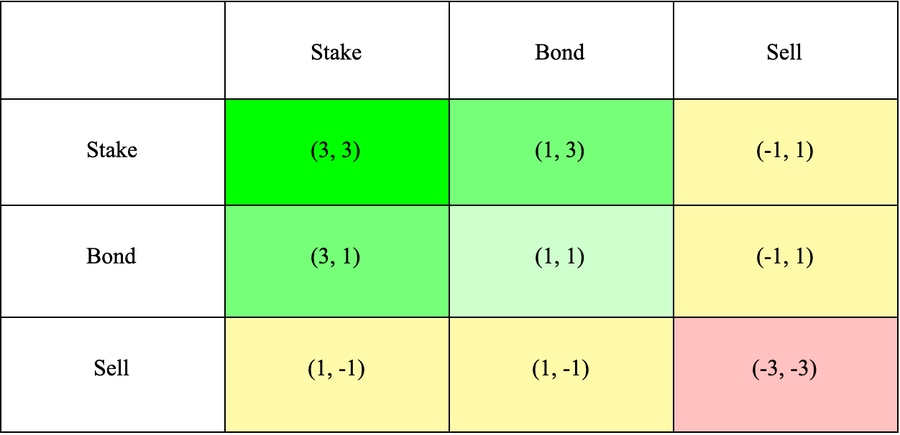

The simplest model of Olympus Doge has two players with three possible actions:

Stake (Buy)

Bond

Sell

Players are most likely to stake when they anticipate an expansion in supply and/or price. Players are most likely to sell when they anticipate a contraction in supply and/or price. Players are most likely to bond when they do not have a strong directional bias but don’t anticipate significant downside.

Staking has the effect of pushing the price up +2. Selling has the effect of pushing the price down -2. The player who moves price gets half of the benefit. Bonding has no price effect but provides a discount of 1.

As you can see, the dominant strategies are all cooperative. Both players’ staking results in 6; stake and bond results in 4; and bond and bond results in 2. Conflicting moves (stake/sell and bond/sell) are neutral. Competition (sell/sell) is the only negative sum outcome, with -6.

This is simplified to a dangerous degree. These dynamics will strengthen and weaken depending on the premium, market outlook, macro environment, and a litany of other factors. Don’t read too hard into the numbers. This is merely meant to demonstrate the positive-sum environment created by cooperation.

Working together produces optimal outcomes, so I urge you not to get involved unless you intend to stick around for the long term. Don’t be that guy who sold Bitcoin at $50 to buy back at $20. This is more like Bitcoin than you probably realize. Unlimited supply does not have to mean no scarcity.

Player Goals

Stakers care primarily about their $OHMD balance. While price is important in valuing their $OHMD and determining the rate at which it grows, it is not the main goal. A smart staker cares only about the short and long term growth prospects of the network. That growth translates into wealth via price and balance growth.

Bonders care primarily about $OHMD price. When they bond, these users lock in a fixed reward in $OHMD. Therefore, network profitability is only helpful in calculating opportunity cost or gain; bonders have their $OHMD gains locked in.

The ideal scenario for a bonder is for price to go up; in this case, the bonder benefits from their discount on $OHMD and the increase in price.

Bonders are still happy if price remains flat; their profit is the discount from the bond. Like stakers, bonders profit from inactivity at or around their buy in via an increasing balance.

Bonders only lose when price goes down beyond the discount on the bond. At this point, the bonder will choose between the $OHMD or the liquidity pool, depending on which one is worth more. Bonders always get to choose the better of the two assets, effectively combining the best pieces of both assets' risk to reward profiles.

Market Dynamics

The default state of the network is at intrinsic value. After some long period of inactivity, price will always return to this level.

Contractions are conceivably only triggered by short-term liquidity crises. Since $OHMD holders have a guarantee that price will come back above intrinsic value eventually, the only sellers below should be those who need a short term exit and are willing to take the extra loss.

Expansions can be triggered by an increase in staking or bonding.

An increase in staking will generally be preceded by purchases from the market. That increases price, which allows the protocol to sell at a higher price and increases yield for stakers. That should serve to bring in more stakers and continue the cycle.

Meanwhile, the rising price increases the bond discount and creates capacity for new bonds. These are preceded by new liquidity, which improves the protocol's ability to carry out sales and increases available exit liquidity.

This positive price-liquidity feedback loop should serve to create sustainable to expansionary periods. However, they work both ways. Falling demand decreases staking rewards and bond capacity, causing demand to fall further. This is an unavoidable fact of system's like this; even the best (i.e. Bitcoin) are no stranger to significant declines after periods of expansion.

But we can work to mitigate busts. This is where the protocol's reserves step in and to catch the market when velocity turns too far to the downside. It does so through forward guidance (the fact that the protocol will buy lowers risk the lower we go, which can mean we don't have to buy) and by buying perpetually below intrinsic value. The treasury ensures that, although bear markets and contractions can and will occur, the protocol can never die.

Last updated